If You Have a Car Insurance Policy, This is the Easiest Way to Try to Cut Your Rate in Half

T his is the trick your auto insurer does not want you to know. Out of all 246 insurers, we found just 7 that will give you an extremely high discount if you drive less than 25 miles per day. Also, there is a select group of insurers that will give a discount for zero recent tickets.

Our rule to find the lowest rate is simple. To get the biggest savings, compare rates from our vast network of agents (in your area).

- During June -- 11,032 U.S. drivers have trusted this to get extreme insurance discounts

- By finding the right insurer, the average driver may save hundreds of dollars a year

- Consumer Fed has warned that 45% of major insurers unfairly hike up loyal customers’ rates just to maximize profits – insurers call it “price optimization.” -- Compare below and keep your insurer honest.

Get discounts in your zipcode from licensed insurers

67% of respondents that shopped in the past year said they obtained images online. And, most shoppers got 2-3 images.

(ComScore Auto Insurance Shopping Report)There is a way to outsmart your auto insurer -- and cut your rate by as much as hundreds of dollars a year.

That's what many of our readers have done so far. Here's exactly how you can drastically lower your rates as well...

Have you seen any of the recent car insurance commercials? Specifically, the ones that claim that if you switch to them, they’ll save you an astonishing $500.00 or more – every year.

Well, if they all claim to save you that much… are those savings really possible with every insurer? Absolutely not! Every insurer is different. They each give different savings depending on unique factors.

For example, any insurer may give you a discount on the following:- If you haven’t been in a car accident in the last 3 years

- If you are over 25 years of age

- If your car is driven less than 7,500 miles annually (or 25 miles/day for 5-6 days a week commute)

- If your car has air bags

- Even if you haven’t had a recent ticket, many insurers give you a discount for something that simple

The fact is: auto insurers give different discounts depending on your situation.

Now, how do you know exactly which insurer will give you the best rate and discounts you need? There's one way to find them. It's by comparing many of their rates quickly.

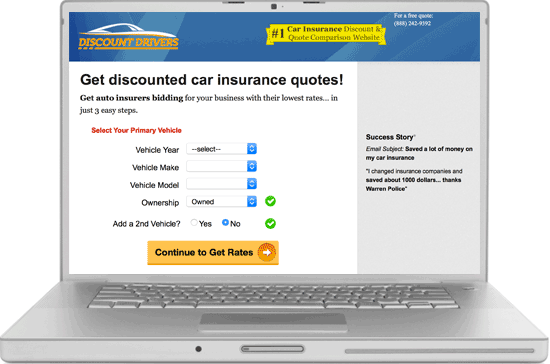

That’s why our car insurance comparison has become so popular. First, answer 4 questions above. You'll confirm this after clicking "See Your Discounts."

Next, complete just two easy steps – this will take about 60 seconds.

Select your primary driving vehicle. Vehicles that have safety devices (such as an alarm or airbags) – often get big discounts on their premium.

Last step is to just complete the contact page. Then, you’ll get free images from multiple insurers in your area. This way, you can pick the policy and rate that best fits you. In this case, those $500 or so savings may actually be possible. Enter your driving details and zipcode, to try it.

Discount Drivers shows how safe drivers are considered low risk to certain insurers. Comparing as many insurance rates as possible is an almost certain guarantee to get the lowest rate.

Many insurance companies see recently ticketed drivers as a huge financial risk. Some of these insurers have decided to reward good drivers (without a ticket within the last 3 years) with highly discounted rates.